All Categories

Featured

Table of Contents

The settlements that would have or else mosted likely to a banking institution are paid back to your individual swimming pool that would have been used. The outcome? Even more money goes right into your system, and each dollar is performing numerous jobs. Recapturing rate of interest and lowering the tax obligation concern is a fantastic tale. Yet it obtains even better.

This money can be used tax-free. You have complete access to your funds whenever and for whatever you desire, without charges, fines, evaluation boards, or extra collateral. The cash you use can be paid back at your recreation without collection payment timetable. And, when the moment comes, you can pass on everything you've constructed up to those you love and respect entirely.

This is how families pass on systems of wealth that make it possible for the future generation to follow their dreams, start services, and make use of chances without losing it all to estate and estate tax. Firms and financial institutions utilize this strategy to develop working pools of funding for their organizations.

What financial goals can I achieve with Wealth Building With Infinite Banking?

Walt Disney utilized this approach to start his dream of developing a motif park for children. An audio financial option that does not depend on a fluctuating market? To have cash money for emergency situations and possibilities?

Sign up with one of our webinars, or attend an IBC bootcamp, all complimentary of cost. At no charge to you, we will certainly educate you more about just how IBC functions, and produce with you a strategy that functions to resolve your trouble. There is no responsibility at any type of factor in the procedure.

This is life. This is heritage (Cash flow banking). Contact among our IBC Coaches instantly so we can reveal you the power of IBC and whole life insurance today. ( 888) 439-0777.

It looks like the name of this idea changes when a month. You may have heard it described as a continuous riches approach, household banking, or circle of wealth. Regardless of what name it's called, infinite financial is pitched as a secret method to develop riches that only rich individuals understand around.

How do I optimize my cash flow with Financial Independence Through Infinite Banking?

You, the insurance holder, placed cash right into an entire life insurance policy with paying costs and getting paid-up additions.

The whole idea of "financial on yourself" just functions because you can "bank" on yourself by taking loans from the plan (the arrow in the graph over going from entire life insurance policy back to the policyholder). There are two different types of financings the insurance provider might use, either straight recognition or non-direct recognition.

One feature called "clean finances" sets the rate of interest on loans to the same rate as the returns price. This means you can borrow from the policy without paying rate of interest or obtaining rate of interest on the quantity you obtain. The draw of unlimited financial is a dividend rates of interest and guaranteed minimal price of return.

The disadvantages of unlimited banking are commonly forgotten or not mentioned in any way (much of the info readily available concerning this idea is from insurance agents, which may be a little prejudiced). Only the cash worth is growing at the returns rate. You also have to pay for the price of insurance, charges, and costs.

Infinite Banking Benefits

Business that offer non-direct acknowledgment car loans may have a lower returns price. Your money is secured into a complicated insurance item, and abandonment charges commonly do not disappear up until you've had the policy for 10 to 15 years. Every long-term life insurance policy is different, yet it's clear a person's total return on every buck invested in an insurance coverage product can not be anywhere near to the reward price for the plan.

To offer a very basic and hypothetical example, allow's think somebody is able to gain 3%, on standard, for every buck they invest on an "boundless financial" insurance policy item (after all costs and charges). If we think those bucks would be subject to 50% in taxes complete if not in the insurance item, the tax-adjusted rate of return could be 4.5%.

We assume greater than ordinary returns on the entire life item and a very high tax obligation rate on bucks not put into the plan (which makes the insurance product look far better). The truth for numerous folks might be worse. This fades in comparison to the lasting return of the S&P 500 of over 10%.

Can I use Infinite Banking For Financial Freedom to fund large purchases?

Unlimited banking is a great item for representatives that sell insurance, but might not be optimum when compared to the less expensive options (with no sales people making fat compensations). Below's a malfunction of several of the other purported benefits of infinite financial and why they may not be all they're gone crazy to be.

At the end of the day you are acquiring an insurance product. We like the protection that insurance provides, which can be acquired a lot less expensively from an affordable term life insurance coverage plan. Unpaid loans from the plan may additionally lower your fatality advantage, decreasing another level of security in the policy.

The concept only works when you not just pay the substantial premiums, but use additional cash money to acquire paid-up enhancements. The possibility price of all of those bucks is incredible exceptionally so when you could instead be purchasing a Roth Individual Retirement Account, HSA, or 401(k). Even when contrasted to a taxed investment account or perhaps an interest-bearing account, unlimited banking may not offer similar returns (contrasted to investing) and equivalent liquidity, gain access to, and low/no fee framework (contrasted to a high-yield cost savings account).

Many individuals have actually never heard of Infinite Financial. Infinite Financial is a means to handle your money in which you produce an individual bank that works just like a regular bank. What does that suggest?

Can anyone benefit from Bank On Yourself?

And thanks to the money value cost savings portion of your whole life insurance plan, you're able to take policy car loans that will not interfere with the growth of your cash. Infinite Banking retirement strategy. Consequently, you can finance anything you require and desire, i.e.,. Simply put, you're doing the financial, yet as opposed to depending on the conventional financial institution, you have your own system and complete control.

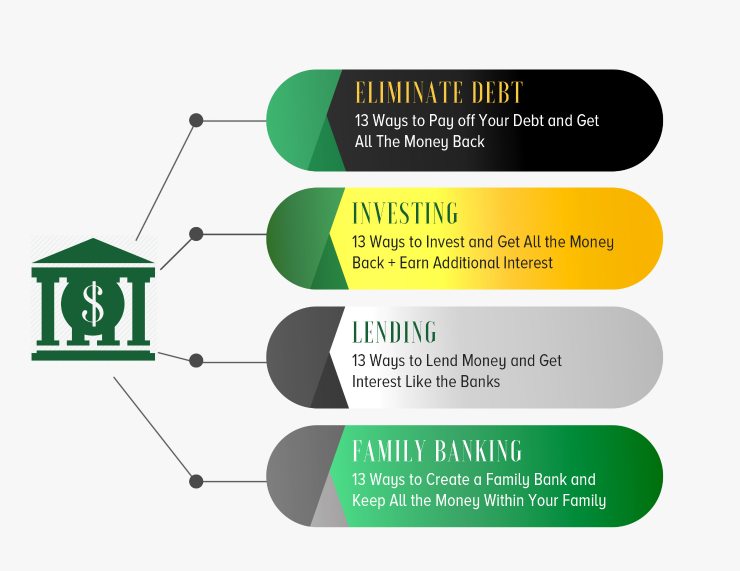

Infinite Financial isn't called by doing this without a reasonwe have infinite methods of executing this procedure right into our lives in order to really possess our lifestyle. In today's article, we'll show you four various means to make use of Infinite Financial in company. In addition to that, we'll talk about 6 methods you can utilize Infinite Financial directly.

Latest Posts

How Does Bank On Yourself Work

Create Your Own Bank

Your Family Bank - Become Your Own Bank - Plano, Tx